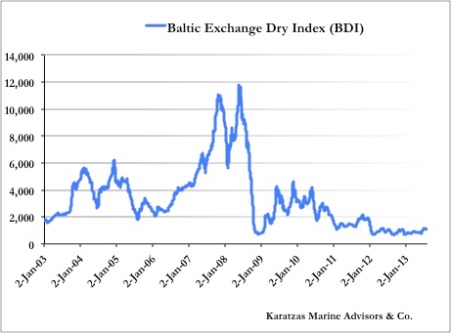

Ever since the Baltic Dry Index (BDI) took a vertical

dive from the top of ca. 12,000 points at the end of May 2008 to the well below

1,000 in a matter of seven short months and its sideways movement ever since

around the 1,000 mark, lots of resources have been expended on the market

recovery and the best strategy to exploit such recovery.

Such drastic change in the index, and by default in freight rates and shipping asset prices, caught the attention of not only the typical market players like shipowners and the shipping banks, but also the attention from players and investors outside the industry such as institutional investors and private equity funds who never before analyzed the shipping industry seriously.

While the highly-wished vessel auctions on industrial scale and sale of distressed assets never materialized in any meaningful way, at least on a scale to satisfy the multi-billion appetite of private equity funds, few projects took place at market related pricing; but still, there are billions and billions and billions of dollars that are on the sidelines or have been committed to be invested in shipping assets; the success rate of converting funds to investments has been disappointing, which begs the question: if there are funds and a tremendous appetite to invest in the shipping industry, and shipping is going though one of its worst troughs ever, what is holding back the investment process?

Unlike other asset-heavy and capital intense industries, shipping is rather fragmented and opaque and based on operational expertise and niche industry knowledge; the execution risk of actually investing in ‘cheap ships’ is tremendous, since buying a vessel is only the first step of crucial decisions: who will be the commercial manager and what will be the vessel employment strategy, how do you select a manager and a partner in shipping, who will be the technical manager of the vessel, how one qualifies such a manager when maintenance standards vary widely across asset classes and local markets, how one evaluates the credit worthiness of a private charterer based across the globe, etc. The execution risk of actually investing in shipping is tremendous; one could be 100% correct on the asset class to invest in and get a great price by buying a vessel at a rock-bottom price, but still there many ways one can lose money on the actual execution.

So, what gives? Reputable publicly traded companies may provide an alternative platform for investing in shipping by taking out of the investment all operational risk; a competent management can take a lot of the guesswork out of selecting asset classes, and prices, and managers, and commercial strategies. Plus, they have the added advantage that they provide a platform with plenty of liquidity. A notable example in 2013 of a shipping company that has convinced Wall Street that can properly manage execution risk is Scorpio Tankers (STNG) by coming up with a business model based on ‘eco design’ products tankers at competitive asset pricing based on their first mover advantage in the market that has been experiencing positive structural changes; year-to-date in 2013, Scorpio raised in four attempts about US$ 950 million in the public equity markets and an oversubscribed debt commitment of US$ 520 million. Although we are aware of several private equity funds having raised or committed hundreds of millions to be invested in shipping assets, we have not seen any of them deploying funds so easily or convincingly. In our experience working with funds and institutional investors, the fact that Scorpio is taking the sting of the operational risk away is a great investment catalyst.

© 2013 Basil M Karatzas, All Rights Reserved

No part of this blog may be reproduced, in whole or in part, under any circumstances, without the prior written consent of the copyright holder. Please contact: info@bmkaratzas.com

No comments:

Post a Comment